A risk appetite framework is a governance system that defines the amount and type of risk an organisation is willing to accept in pursuit of its objectives. It establishes clear, quantifiable boundaries for risk-taking to ensure that decisions across technology, operations, and compliance are aligned and consistent.

Understanding the Framework's Core Purpose

A risk appetite framework (RAF) translates risk management from a theoretical policy exercise into a practical, operational discipline. Its primary function is to eliminate ambiguity. It creates a shared, precise vocabulary for business leaders, IT managers, and compliance teams to discuss and manage risk.

Without such a system, decisions are often made in silos based on inconsistent assumptions about what constitutes "acceptable" risk. This can lead to inefficient resource allocation and unpredictable outcomes.

For CISOs and compliance leaders, the framework is a tool for making defensible decisions. It provides a structured rationale for why one security control is funded over another, or why a specific level of system downtime is acceptable while another requires immediate escalation.

From Strategic Intent to Operational Reality

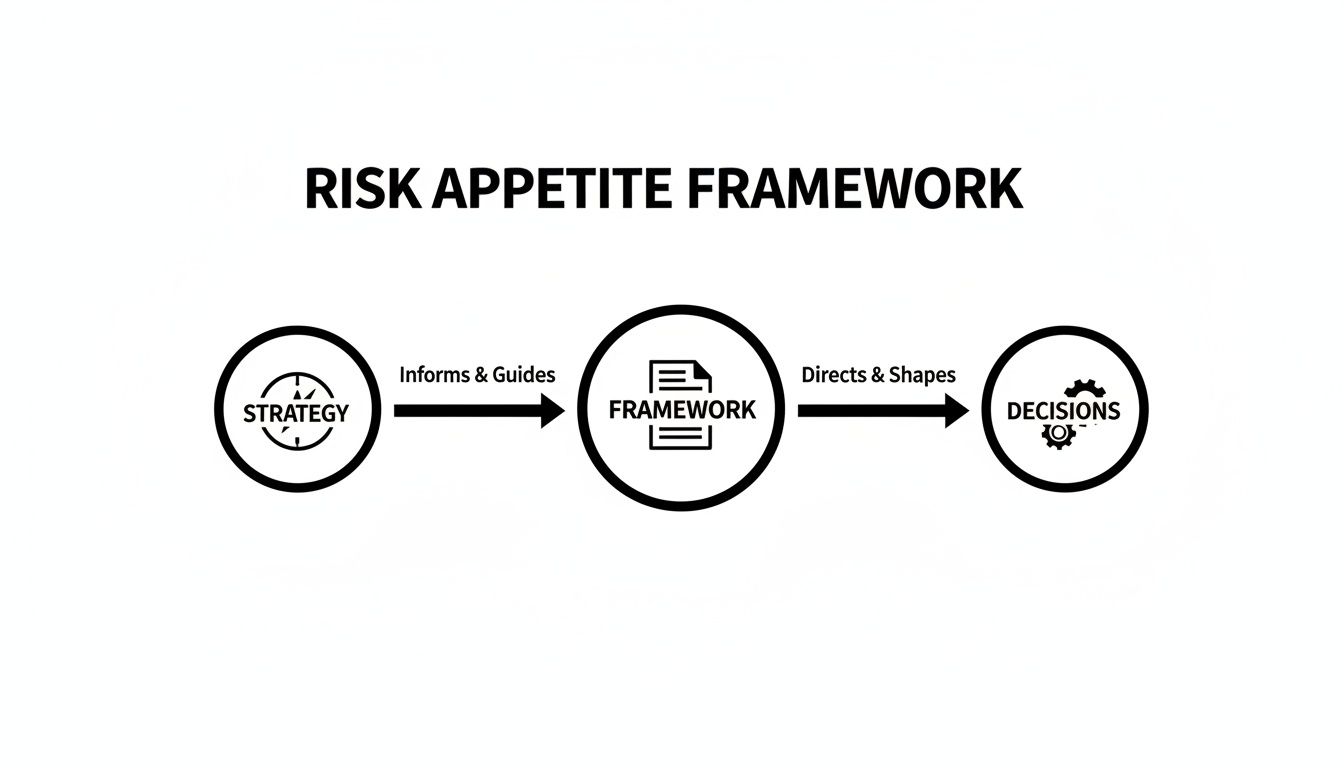

The primary value of a risk appetite framework lies in its ability to connect high-level strategy to daily operations. It acts as a governing mechanism to ensure that the cumulative effect of many small, individual decisions does not inadvertently push the organisation beyond a level of risk that senior leadership has approved. This alignment is critical for maintaining stability and achieving long-term objectives.

A well-engineered risk appetite framework is foundational to demonstrating mature governance. It provides auditors and regulators with verifiable evidence that risk is managed systematically, not reactively.

Why It Is Essential in Regulated Environments

In sectors governed by regulations such as DORA, NIS2, or GDPR, a documented and operational RAF is a non-negotiable component of a mature compliance posture. Regulators view it as a key indicator of an organisation’s risk maturity and operational resilience. It is the primary evidence that management has formally considered, approved, and is actively overseeing the organisation's risk exposure.

This system provides the structural basis for a robust governance model. The broader context is further detailed in our guide to enterprise risk management.

An effective framework demonstrates that an organisation has a deliberate, repeatable process for:

- Defining acceptable risk levels: Setting explicit limits for specific risk areas like cybersecurity incidents, data privacy breaches, or third-party service failures.

- Guiding resource allocation: Directing capital, personnel, and technology toward mitigating the risks that matter most, based on the approved appetite.

- Ensuring consistent decision-making: Providing teams with clear boundaries to operate within, balancing agility with control.

The Core Components of an Effective Framework

A risk appetite framework is a system, not a single document. Its components work in concert to translate high-level strategy into clear, operational rules. An effective framework that withstands audit scrutiny requires a clear understanding of its constituent parts.

The objective is to move risk management from abstract concepts to concrete, measurable actions. It ensures that when an engineer, product manager, or compliance officer makes a decision, they are all operating within the same approved boundaries. This distinguishes mature governance from reactive problem-solving.

The framework provides a direct link between strategy and daily decisions. It is a mechanism for strategy execution, not merely a compliance artefact.

This flow illustrates that the framework is not a separate exercise but an integral part of executing strategy.

To make this practical, the framework is built from several essential components. Each one translates the high-level vision into something teams can measure and act upon.

The table below outlines these core components, explaining their purpose and providing practical examples within a technology environment.

Key Components of a Risk Appetite Framework

| Component | Purpose | Practical Example |

|---|---|---|

| Risk Appetite Statement | A board-approved declaration on the type and amount of risk the organisation will accept. | "We have a low appetite for incidents that compromise customer data integrity or disrupt critical services for more than one business hour." |

| Risk Thresholds | The maximum acceptable level of risk before action or escalation is required. | "No more than 5% of production servers may have unpatched critical vulnerabilities older than 14 days." |

| Key Risk Indicators (KRIs) | Predictive metrics that serve as an early warning system when approaching a threshold. | "Percentage of critical third-party suppliers without a current SOC 2 Type II report on file." |

| Governance and Roles | Defines accountability, from the board down to operational teams. | "The CISO is responsible for reporting KRI breaches to the Risk Committee quarterly." |

These components function as an integrated system. The statement sets the direction, thresholds define the limits, KRIs provide early warnings, and governance ensures clear accountability.

The Risk Appetite Statement

The Risk Appetite Statement is the foundational document. It is a concise, board-approved declaration that articulates the level of risk the organisation is willing to accept to achieve its objectives. A common failure is making this statement too vague to be operationally useful.

An effective statement avoids jargon and is clearly understood by personnel at all levels.

Instead of a generic phrase like "a low appetite for cyber risk," a precise statement would be: "We have a low appetite for incidents that compromise customer data integrity or disrupt critical services for more than one business hour." This clarity enables the setting of specific, measurable targets.

Risk Thresholds and Tolerances

If the statement is the strategic objective, Risk Thresholds are the operational guardrails. They are the specific, quantifiable limits that define unacceptable risk levels.

- Risk Thresholds represent the absolute maximum limit for a specific risk.

- Risk Tolerances define the acceptable deviation from a specific target or control objective.

For example, a risk threshold might be: "No more than 5% of production servers can have critical vulnerabilities unpatched for more than 14 days." The tolerance might permit a temporary excursion to 7% during a major cloud migration, but only with a formally documented risk acceptance.

These metrics must be measurable and directly linked to data from existing systems. A threshold that cannot be monitored provides no effective control.

Key Risk Indicators (KRIs)

Key Risk Indicators (KRIs) are the early-warning system. They are predictive metrics designed to signal when the organisation is approaching a risk threshold, well before it is breached. KRIs measure risk exposure, distinguishing them from Key Performance Indicators (KPIs), which measure performance.

A KRI functions like a smoke detector. Its purpose is not to confirm a fire but to provide an early warning, enabling proactive intervention before a significant incident occurs.

For example, a KRI for supply chain risk could be "the percentage of critical vendors without a current SOC 2 Type II report." An upward trend in this metric on a monitoring dashboard indicates increasing risk, allowing for corrective action before a vendor-related incident materialises.

Governance Roles and Responsibilities

A framework is ineffective without clear ownership. A robust governance structure establishes accountability by mapping specific responsibilities. This is further explored in our guide on governance, risk, and compliance.

A typical governance structure includes:

- The Board or Management Body: Holds ultimate accountability. This body approves the Risk Appetite Statement and oversees the framework's effectiveness.

- Risk Committees: Review KRI reports, challenge business units on their risk levels, and recommend changes to the framework.

- Operational Teams: Responsible for the day-to-day management of controls, monitoring of KRIs, and reporting of breaches through established escalation paths.

This distribution of duties ensures that accountability is clear and traceable—a key requirement for regulatory audits.

Aligning Your Framework with Regulatory Mandates

A well-constructed risk appetite framework does more than guide internal decisions; it serves as a primary indicator of an organisation's risk management maturity and is considered core evidence of operational resilience by regulators.

Regulations like DORA, NIS2, and GDPR require a demonstrable, systematic approach to managing risk, not just adherence to checklists. The framework provides this proof.

During an audit, the framework shows that the organisation has a board-approved, structured methodology for making risk-based decisions. It shifts the conversation from reacting to incidents to proactively managing exposure. Instead of presenting a list of controls, you can demonstrate a coherent system that explains why those controls exist and how they link to the organisation's strategic risk tolerance.

This documented, evidence-based approach makes compliance an engineered outcome of the risk management system, rather than a separate, administrative exercise.

Connecting the Framework to Specific Regulations

A single, robust framework can address the core principles of multiple regulations simultaneously. The key is to map the framework's components—statements, thresholds, and KRIs—to the specific outcomes each regulation seeks to achieve.

- DORA (Digital Operational Resilience Act): This regulation focuses on ICT risk, particularly third-party dependencies and operational disruptions. A clear risk appetite statement for ICT third-party risk directly addresses DORA's core concerns. For example, setting a threshold for the maximum acceptable downtime for a critical service provided by a vendor demonstrates systematic management of supply chain resilience.

- NIS2 (Network and Information Security Directive): NIS2 expands cybersecurity obligations and mandates strong risk management practices. The framework can define the organisation's appetite for specific cyber threats, such as ransomware or data exfiltration. A measurable KRI, like "the percentage of critical assets with unpatched, high-severity vulnerabilities older than 30 days," provides tangible evidence of a managed security posture.

- GDPR (General Data Protection Regulation): GDPR is built upon the principle of accountability. A risk appetite framework demonstrates this by defining a clear tolerance for data protection failures. A statement such as, "We have zero appetite for the unencrypted storage of sensitive personal data," supported by a KRI that monitors for this condition, provides concrete evidence of active data privacy risk management.

How Regulators Scrutinise This in Practice

Regulators increasingly focus on the operational effectiveness of risk management systems, not just their documentation. The European Central Bank (ECB), for example, has made the risk appetite framework a cornerstone of its Supervisory Review and Evaluation Process (SREP) for operational and ICT risks.

Recent ECB's supervisory methodology reports indicate that weak integration of the risk appetite into operations is a common finding, often triggering mandatory remediation plans. Regulators expect to see the framework woven into business-as-usual activities and decision-making processes.

An auditor's primary goal is to verify that your risk management is systematic and repeatable. A risk appetite framework is your most effective tool for demonstrating this, as it links board-level strategy directly to operational controls and measurable outcomes.

Ultimately, aligning your framework with these mandates is about demonstrating control and foresight. It proves your organisation has a deliberate, traceable, and accountable process for managing the risks that matter most to regulators. This transforms the audit from a defensive posture into a proactive demonstration of mature governance.

Putting the Framework into Practice

Designing a risk appetite framework is a governance exercise; implementing it is an engineering and operational challenge.

The goal is to transition the framework from a theoretical document into a functioning system that informs daily decisions. Success depends on a structured, deliberate approach that embeds risk-aware decision-making into the organisation’s core processes.

This requires a clear implementation plan covering stakeholder engagement, process integration, and technical monitoring mechanisms. The objective is to create a system that is not just documented but is actively used to guide real-world decisions.

Securing Stakeholder Engagement and Sponsorship

Effective implementation begins with genuine buy-in from all levels of the organisation, cascading from the top down.

-

Board-Level Sponsorship: The board must formally approve the Risk Appetite Statement. This act provides the framework with its mandate, signalling it as a strategic priority, not merely a compliance task. This top-level support is critical for securing resources and overcoming organisational inertia.

-

Management Buy-In: Middle managers, such as IT heads and business unit leaders, must understand how the framework supports their objectives. The focus should be on practical benefits, like clearer decision-making boundaries or a more defensible basis for budget requests. When they perceive it as a tool that empowers them, they become its strongest advocates.

-

Operational Team Training: Personnel who manage risk daily—engineers, analysts, and project managers—require practical training that connects abstract thresholds to their specific work. For example, a development team needs to understand how the appetite for software vulnerabilities directly influences their release schedules and patching priorities.

Integrating the Framework into Core Business Processes

A risk appetite framework is only effective if it is integrated into the organisation's operational fabric. If it remains a siloed document, it will have no real-world impact.

A key challenge is ensuring the framework is practical enough for widespread use. While IACPM research on risk appetite frameworks shows that many firms struggle with this, those that succeed see significant benefits, including better alignment of risk profiles with appetite and fewer major risk breaches.

Key integration points include:

- Strategic Planning and Budgeting: The framework should inform resource allocation. A low appetite for system downtime, for instance, must be supported by budget for resilient infrastructure and recovery capabilities.

- Incident Response Protocols: Escalation rules should be directly linked to risk thresholds. A breach of a critical KRI should automatically trigger a pre-defined response plan, engaging the appropriate stakeholders immediately.

- Change Management: All significant technology or process changes must be evaluated against the risk appetite. This ensures new initiatives do not inadvertently push the organisation beyond its approved risk limits.

The true test of a framework’s integration is whether it influences decisions before an adverse event, not just during the post-mortem analysis. It should function as a proactive guide for planning, not a reactive tool for investigation.

For organisations seeking to systematise this integration, a structured repository for evidence is essential. Our guide on using a document management system for compliance explains how to link policies to operational proof, creating a traceable record that is invaluable during an audit.

Monitoring, Reporting, and Continuous Improvement

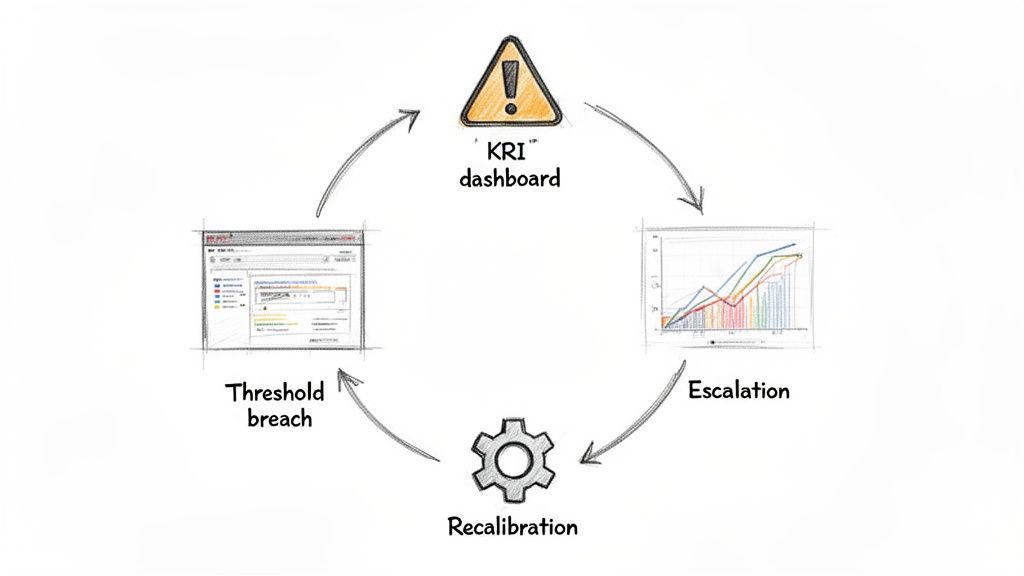

A risk appetite framework is not a static document; it is a dynamic governance system. Its value is realised through the continuous processes of monitoring, reporting, and refinement.

Without these feedback loops, the framework becomes disconnected from operational reality and cannot adapt to new threats or changes in business strategy.

The purpose of monitoring is to verify that the organisation is operating within its agreed-upon risk boundaries. This is achieved by systematically tracking Key Risk Indicators (KRIs) against their pre-defined thresholds. This process requires clear ownership for data collection, analysis, and interpretation.

Effective Reporting Mechanisms

Effective reporting translates raw KRI data into actionable intelligence. To be useful, reports must be tailored to their audience to ensure relevance and prompt the appropriate response.

-

Operational Dashboards: For IT managers and team leads, providing granular, near-real-time data on specific KRIs (e.g., patching cadence, privileged access accounts) is necessary for managing day-to-day controls.

-

Management Summaries: For risk committees and senior managers, an aggregated view is required. These reports should highlight trends, identify KRIs approaching or exceeding thresholds, and provide concise explanations for deviations.

-

Board-Level Overviews: The board requires a high-level, strategic summary. This report should focus on the overall risk posture relative to the approved appetite, detailing any significant breaches, their business impact, and the corresponding remediation plans.

The Continuous Improvement Loop

Monitoring and reporting provide the inputs for a continuous improvement cycle that maintains the framework's relevance. This cycle is activated by specific triggers that prompt a review and, if necessary, recalibration of the framework. A framework that does not evolve becomes obsolete.

A risk appetite framework should be treated as a living system. Its ability to adapt to changes in the business and threat environment is what determines its long-term value as a governance tool.

Recalibration triggers ensure the framework remains aligned with reality as the organisation evolves.

Common Recalibration Triggers:

- Shifts in Business Strategy: Launching a new product or entering a new market introduces new risks that must be assessed against the current appetite.

- Changes in the Threat Landscape: The emergence of new attack vectors may necessitate lower thresholds for related risks.

- Major Regulatory Updates: New legislation like DORA or NIS2 requires a review to ensure the framework's limits and controls meet the new legal standards.

- Significant Incidents: A major security breach—within the organisation or at a peer—should trigger a review of the corresponding risk appetite and tolerance levels.

This continuous cycle of monitoring, reporting, and recalibrating is what transforms the framework from a static policy into an active system that enhances organisational resilience and risk intelligence. An analysis of enterprise risk re-engineering provides further detail on how integrated frameworks and recalibration triggers reduce the likelihood and impact of significant risk events.

How to Demonstrate Adherence During an Audit

Possessing a risk appetite framework document is the starting point. During an audit, this document is treated as a statement of intent. Auditors are trained to look beyond policy and verify that systems are operating as described.

The objective is to present a clear, traceable line of evidence demonstrating that the framework is an integral part of how the organisation governs itself and makes decisions. The focus is not on presenting a policy but on proving its operational reality. An auditor seeks to verify that the framework consistently guides choices, resource allocation, and responses to events.

From Documentation to Demonstrable Proof

Effective audit preparation involves collecting and organising evidence that proves the framework is embedded in daily operations. This is about building a narrative of a well-managed system. An auditor is not inspecting a file; they are verifying the effectiveness of a control system by examining its outputs.

The key is to present a portfolio of evidence that is organised, indexed, and directly mapped to the framework’s core components. This proactive approach transforms the audit from a reactive search for documents into a structured demonstration of control. It shows that the organisation treats compliance as an engineering and governance discipline.

The evidence must answer fundamental audit questions:

- How does the board or risk committee oversee adherence to the stated appetite?

- What is the defined process when a Key Risk Indicator (KRI) breaches its threshold?

- Where are risk-based decisions documented and justified with reference to the framework?

Assembling Your Evidence Pack

The evidence pack should be a curated collection of operational artefacts that tells a clear story of the framework in practice. Instead of providing raw data, present specific examples that tie directly back to the risk appetite statements and thresholds.

An auditor seeks confidence that your framework is more than a theoretical construct. Tangible proof of its application in real-world scenarios—debates in meetings, decisions in change logs, and actions in incident reports—provides that assurance.

The evidence pack should include items such as:

- Meeting Minutes: Records from board or risk committee meetings where KRI dashboards were reviewed and risk appetite was explicitly discussed, including decisions made based on that information.

- Change Logs and Decision Records: Documentation showing how KRIs or their thresholds were adjusted over time, with a clear rationale for the changes. This demonstrates a dynamic, managed framework.

- Incident Reports: Post-incident analysis that explicitly references which risk thresholds were breached and details the escalation and response actions taken, as prescribed by the framework.

- System Reports: Exports from monitoring tools that directly correlate with defined KRIs, showing consistent tracking and reporting over time.

Assembling this evidence demonstrates accountability and transforms the audit from a test into a validation of mature, systematic governance.

Frequently Asked Questions

This section provides direct answers to common questions about implementing a risk appetite framework.

What Is the Difference Between Risk Appetite and Risk Tolerance?

These terms are often used interchangeably, but they represent distinct concepts in a risk management system.

Risk appetite is the strategic, high-level statement approved by the board. It describes the organisation's general attitude toward risk-taking, such as, “We have a very low appetite for any disruption to our core customer-facing services.” It is a guiding principle, not a specific metric.

Risk tolerance is the operationalisation of that principle. It sets a specific, quantifiable limit. For the appetite described above, a corresponding tolerance might be, “No more than 4 hours of unplanned downtime for critical systems per quarter.”

Tolerance is the measurable boundary that indicates when the organisation has deviated from its stated appetite and requires action.

How Often Should a Risk Appetite Framework Be Reviewed?

A formal review should be conducted at least annually. This allows the board or a dedicated risk committee to ensure the framework remains aligned with the organisation's strategic goals.

However, a risk appetite framework is a dynamic instrument. It must be revisited whenever a significant change occurs.

Triggers for an ad-hoc review include a major shift in business strategy, the emergence of a new and material threat, or a significant incident that tested or exceeded tolerance levels. While Key Risk Indicators (KRIs) provide continuous monitoring, these formal reviews ensure the entire framework remains fit for purpose.

A review is not a rubber-stamping exercise. It is an active process of challenging the framework's underlying assumptions to confirm their continued validity in the current business and threat environment.

Can Smaller Organisations Implement a Risk Appetite Framework?

Yes. For organisations in regulated industries, it is a recommended practice. The core principles of a risk appetite framework are scalable.

A smaller company’s framework will be less complex than that of a multinational corporation, but it serves the same fundamental purpose: to focus limited resources on the risks that matter most.

The key is proportionality. The framework should be practical, using clear, simple metrics that can be tracked without a large, dedicated risk management function. This approach demonstrates to regulators, partners, and customers that the organisation's approach to risk is systematic and deliberate, which is a key indicator of maturity regardless of size.

A risk appetite framework is a statement of intent until it is supported by verifiable evidence. For an audit, clear, traceable proof of operation is required. AuditReady is designed to connect policies and controls to the operational evidence auditors need to verify. Visit AuditReady to learn how to approach your next audit with a complete evidence trail.